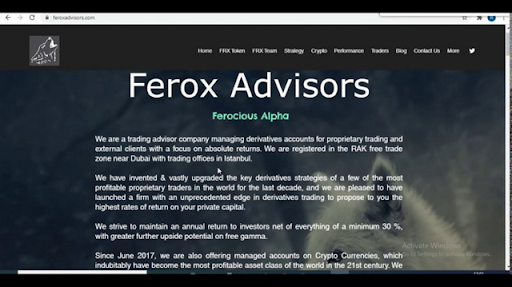

FEROX

FRX is an autonomous interest rate trading protocol.

trading advisory firm that manages derivative accounts for exclusive trading and external clients with a focus on absolute returns. We are registered in the RAK free trade zone near Dubai with a trading office in Istanbul.

We have discovered & greatly improved the key derivatives strategies of some of the world's most profitable proprietary traders over the past decade, and we are delighted to have launched a company with unprecedented excellence in derivatives trading to propose to you the highest price for your personal return on investment.

We strive to maintain a net annual return to investors of all of them at least 30%, with the potential for further larger increases in free gamma.

Since June 2017, we also offer managed accounts in Cryptocurrencies, which have become the most profitable asset class in the world in the 21st century. We specialize in exchange-listed derivatives and can help you achieve benchmark-beating returns in two ways:

28 APR 2020 (FEROX ADVISORS NEWSLETTER)

Dear Investors & Friends,

The recent spike in volatility and financial collapse during the Covid 19 crisis highlighted one critical element of the asset management business: mutually beneficial organic brokerage relationships at the human level.

The recent derivatives trades we did during Q1 2020 are, in my personal opinion, some of the best trades I have shown at any company I have worked with in my entire career, and the list includes some of the record-breaking performances on the European Index of options for exchanges as well as reaching the number 1 spot in the world in trading driven by very low latency events.

If our previous broker's auto-liquidation algorithm was not mistakenly performed due to a series of sharply escalating stress tests triggered by fears of broker bankruptcy when implied volatility for most options positions briefly shot over 100 overall, currently our combined portfolio is net equity returns. of all things for YTD 2020 will stand, with conservative forecasts, at least 60% + profit in just less than 3 trading months.

Instead of having part of our portfolio liquidated without even a word of warning or the opportunity to readjust it manually, we are standing around breaking even for the year in overall performance; Therefore, it was an easy decision for us to quickly transform our prime broker into a more promising and younger company that requires human interaction for margin calls and gives their customers the opportunity to take control of their positions. It will become a standard business operation going forward, with 360 ° human checks for account management regardless of what automated system we or the broker uses.

While I like 99% of the original, this time I'm going to make an exception by taking a page from Robert Mercer's book (of Renaissance Technologies) and agreeing that data precision is perhaps the single most important element in retesting methodology.

I'm sharing with you a full development timeline of our two flagship fully automated strategies, and how they evolved into their final versions after about 2.5 years in development. While the philosophy of Alaz and Rainmaker has remained the same over the years, our data enhancements have resulted in much better parameters and code, and we are happy to offer final versions of both from March 2017 onwards: Alaz 7 & Rainmaker 4.3.

Below you can find some comments on the production notes for each along with the appropriate timeline:

While I like 99% of the original, this time I'm going to make an exception by taking a page from Robert Mercer's book (of Renaissance Technologies) and agreeing that data precision is perhaps the single most important element in retesting methodology.

I'm sharing with you a full development timeline of our two flagship fully automated strategies, and how they evolved into their final versions after about 2.5 years in development. While the philosophy of Alaz and Rainmaker has remained the same over the years, our data enhancements have resulted in much better parameters and code, and we are happy to offer final versions of both from March 2017 onwards: Alaz 7 & Rainmaker 4.3.

Below you can find some comments on the production notes for each along with the appropriate timeline:

3 AUGUST 2015

Our 2nd fully automated algorithm "Rainmaker" was launched at AUG 2015. This strategy is inversely correlated with our first algo "Alaz", so together they form a neutral profile that is completely risky for generating explosive alpha in all market climates. Contact Us to find out how you can participate in one of our managed accounts or an upcoming fund & private placement offer.

EDITION OF SYSTEMATIC TRADING

- Our unique algorithmic and technical systems developed over years of winning derivatives trading experience go beyond mathematical probability by incorporating prevailing market sentiment and human reactions.

- The system adapts to different volatility conditions, implied and manifest, with the volatility model being adjusted during our tenure at the first European Volatility trading firm.

- Complete Intraday Trading Optionality, which can give investors cash at the end of each trading day. Absolute liquidity within a week even with a long term structured portfolio

- Discretionary control over political events or extraordinary black swan events that can create irrational activity in the market. The appearance of the signal is always confirmed by discretionary macro analysis before trading.

- Predefined risk management, pre-set stop losses before trading and strict maximum loss limits per day and per month are automatically applied.

- Zero cost management model, we only charge on profits, as a vote of confidence in our strategy.

- Possibility to extract a more aggressive alpha by combining intraday trading with long-term options, for which we have been a major market maker for the last 5 years.

TRACK RECORD MANAGED ACCOUNT

Our track record consists of the following activities:

1) Trading Discretionary Position Options (US & European Indices, Preferred Commodities, FX Pairs & Fixed Income Derivatives)

2) Intraday Automated Trading (Index Futures, Commodity Preferred Futures, Forex Pairs and multiple single stocks)

3) Cryptocurrency Trading (Exchanges Traded, some OTC deals, Initial Offers and Decentralized Trading)

RISK OF ADJUSTABLE TOTAL REALIZATION

for the most risk-sensitive investors, with maximum monthly withdrawals capped at 3% and peak through-maximums set at 6% at all times).

After initiating automatic execution since Q3 2014 via an American brokerage firm, we have removed all past performance data from our website in accordance with US based regulations. For realization results and statistics, do not hesitate to contact us at info@feroxadvisors.com or via our contact page.

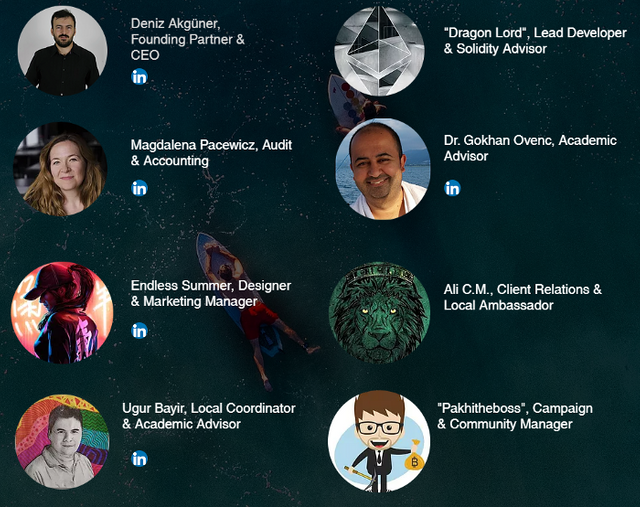

DENIZ AKGUNER

DIRECTOR

A certified EUREX and LIFFE derivative trader, Deniz began his career at Royal Dutch Shell, where he first became acquainted with trading in physical and energy commodities. Relocating to Amsterdam to become one of the most profitable options market makers at Tibra Capital, he was later recruited to Zurich as head of trading at the Swiss hedge fund Da Vinci Invest AG.

After refining his signature derivatives strategy there, he then entered the fast-growing Middle East region to launch his own hedge fund in the free zone sometime in 2015. He is also a co-founder of the Cayman Islands-based trading company GKAM, and is involved with the venture. other entrepreneurs such as Kaos Capital. Deniz holds a BA / BS in International Politics & Philosophy from Bosphorus University and subsequently completed his Masters studies in International Finance at Columbia University, New York.

Ferox Advisors is not only a hedge fund company, but also provides a token hedge fund called FRX Tokens. The FRX token is a TRC20 token designed on the Tron blockchain. With this combination, Alpha Hedge Fund Forex Advisors provide a decentralized token hedge fund with the productivity capabilities and benefits of the DFI ecosystem. FRX tokens can be purchased and received by users through the Seed Round program. Users can get multiple bonus levels of up to 300% in this program. The bigger the investment, the higher the bonus.

FRX token utility

Apart from participating in hedge funds, FRX is the betting token of choice directly from the Firx Consulting site. This bet will be a dynamic version of binary options (or bet on consistent spreads), allowing users to make daily predictions about the prices of cryptocurrencies and major products such as gold, silver and crude oil via FRX tokens in the payout structure.

Ferox Advisor Tokenomics:

Forex Advisors is a private limited company in which they have invented crypto tokens - for investors to share their profits and for partners to participate. The FRX token will feature liquidity mining and standard yield cultivation, enabling its holders to deposit tokens and generate dividends.

The project plans to deliver a total of 70,000 million TRX tokens. The company says 400 million tokens will be minted in the first year of the first year and sold and distributed in the second year. The rest will be set aside for split funding, special promotions and development roadmaps.

FRX mentioned in the previous paragraph is a trading company that focuses on trading cryptocurrencies and their derivatives. The company specializes in account management for investors and gets returns based on their investment. FRX has created their platform token called FRX which is tron based. This token is designed on the Tron Blockchain, one of the fastest, scalable, secure and highly efficient blockchain networks in the world. FRX is a domestic token of the FRX decentralized hedge fund platform.

PRESALE FRX INVESTMENT LEVELS are as follows:

Investing 10,000 TRX, 1 TRX = 3 FRX, Investors will get 27,000 FRX by transferring 9000 TRX to the FRX wallet above

Investments worth 10,000 TRX to 50,000 TRX (1 TRX - 3.3 FRX) TRX deposits worth 33,000, you will get 99,000 FRX

Investments up to 50,000 TRX up to 300,000 TRX (1 TRX - 3,6 FRX) Deposit 100,000 TRX, you will receive 360,000 FRX

Investment up to 300,000 TRX and above attract (1 TRX - 4FRX) Save 500,000 TRX will, you will receive 2,000.00 FRX Roadmap

FRX Coin is Faster, Easier to Deposit and Whitdrawal Method, especially in developing countries, there is an inherent need for easy deposit and withdrawal services. Using FRX Coin, Powered by Blockchain, and a combination of local deposits and other smart payment systems, deposits and withdrawals have never been easier. It is safe, protected, traceable and completely transparent. FRX Coin is designed for flexible cryptocurrency exchange trading. That's why the platform is compatible with multiple devices for more challenging trades.

For more information, please visit the link below:

Website: http://feroxadvisors.com/team

Twitter: https://twitter.com/feroxadvisors

Telegram: https://t.me/FRXalpha

Medium: https://frx.medium.com/

Github: https://github.com/opentron/opentron

$ FRX #Ferox #ITO #SeedRound #TronNetwork #DeFi

Komentar

Posting Komentar